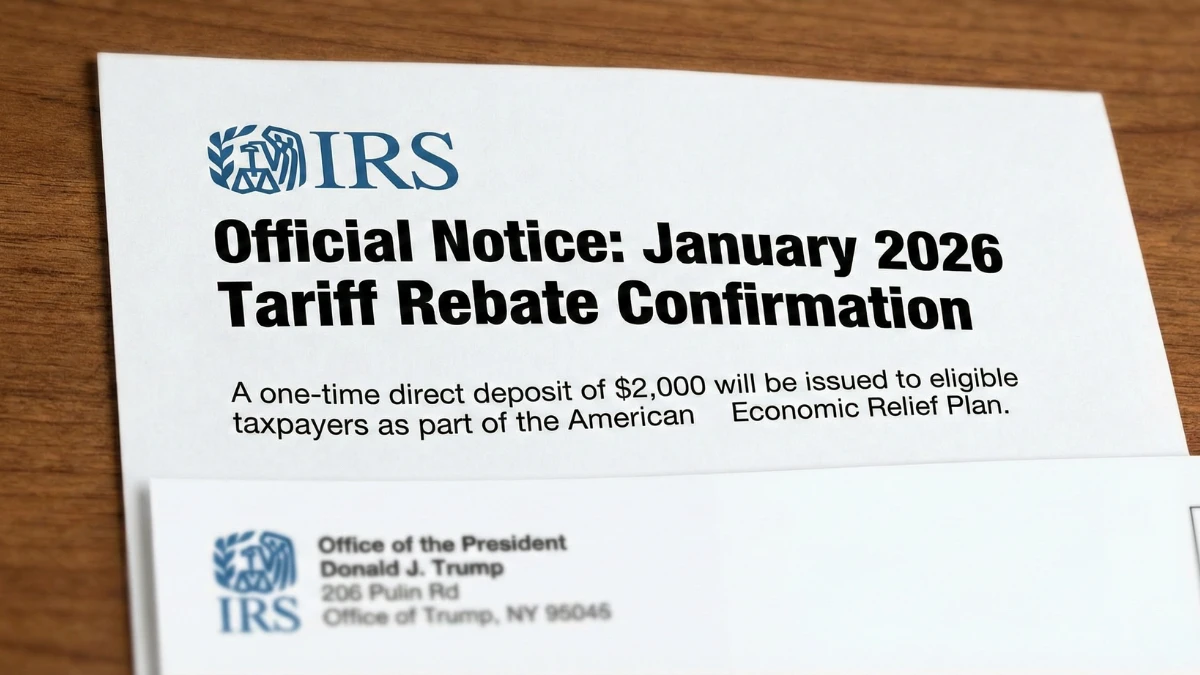

The claim that the IRS has confirmed a $2,000 direct deposit tariff rebate for January 2026 is circulating widely, but the reality requires careful explanation because while tariff-related consumer relief has been discussed in policy circles, no blanket, automatic $2,000 rebate for every taxpayer has been finalized, and any payment would depend on legislative approval, eligibility rules, and IRS implementation details.

Who Would Administer a Tariff Rebate Payment

If approved, any tariff rebate or direct payment would be administered by the IRS using existing tax records and payment systems, similar to prior federal relief programs, with distribution tied to filed returns, income data, and valid direct deposit information.

January 2026 Tariff Rebate – Current Status Overview

| Category | Details |

|---|---|

| Payment Amount | Up to $2,000 (proposed) |

| Payment Method | Direct deposit / mailed check |

| Administering Agency | IRS |

| Funding Basis | Tariff-related consumer relief |

| Eligibility | Income and filing status based |

| Status | Under discussion / not finalized |

| Timing | Earliest possible January 2026 |

What a “Tariff Rebate” Means in This Context

A tariff rebate refers to potential consumer relief funded by tariff revenues or cost-offset measures intended to reduce price pressure from import duties, but such rebates require explicit congressional authorization and clear eligibility definitions before the IRS can issue payments.

Eligibility Rules Being Discussed

Eligibility for a $2,000 tariff rebate would likely mirror prior relief structures, focusing on income thresholds, tax filing status, residency requirements, and valid IRS records, meaning higher-income filers could see reduced amounts or be excluded.

How Direct Deposit Would Work

If approved, taxpayers with direct deposit information already on file would likely receive funds first, followed by mailed checks for others, and no separate application would be required if IRS records are current.

How to Avoid Misinformation and Scams

Because no final confirmation exists yet, taxpayers should avoid unofficial links, social media claims, or requests for personal information claiming to “unlock” a rebate, as the IRS never charges fees or asks for sensitive details by text or email.

Key Points Taxpayers Should Remember

- No final IRS confirmation of an automatic $2,000 tariff rebate yet

- Any payment would require congressional approval

- Eligibility would depend on income and tax records

- Direct deposit would be the fastest payment method

- Scam messages often appear during rebate rumors

- Official IRS notices are the only reliable source

Conclusion

The idea of an IRS January 2026 $2,000 direct deposit tariff rebate remains a proposal under discussion rather than a confirmed payment, and taxpayers should wait for official legislation and IRS announcements before expecting any deposit.

Disclaimer

This article is for informational purposes only and reflects ongoing discussions and public claims that may change. Payment amounts, eligibility rules, and timelines are subject to official government approval and IRS notification.